Traders are being confused because of some Scam Prop firms. So, they want to ensure “Are prop firms legit?”.

Yes. In most countries, proprietary trading firms are legal. Many traders have found success working with them. It is crucial to do your research before engaging with a prop firm.

What is a Prop Firm?

A prop firm is also known as a proprietary trading firm. It is a legitimate organization that offers traders the opportunity to trade in the financial markets using provided capital.

These companies are well known for their expertise in managing risks.

They offer traders the opportunity to enhance and profit from their trading skills in a structured environment.

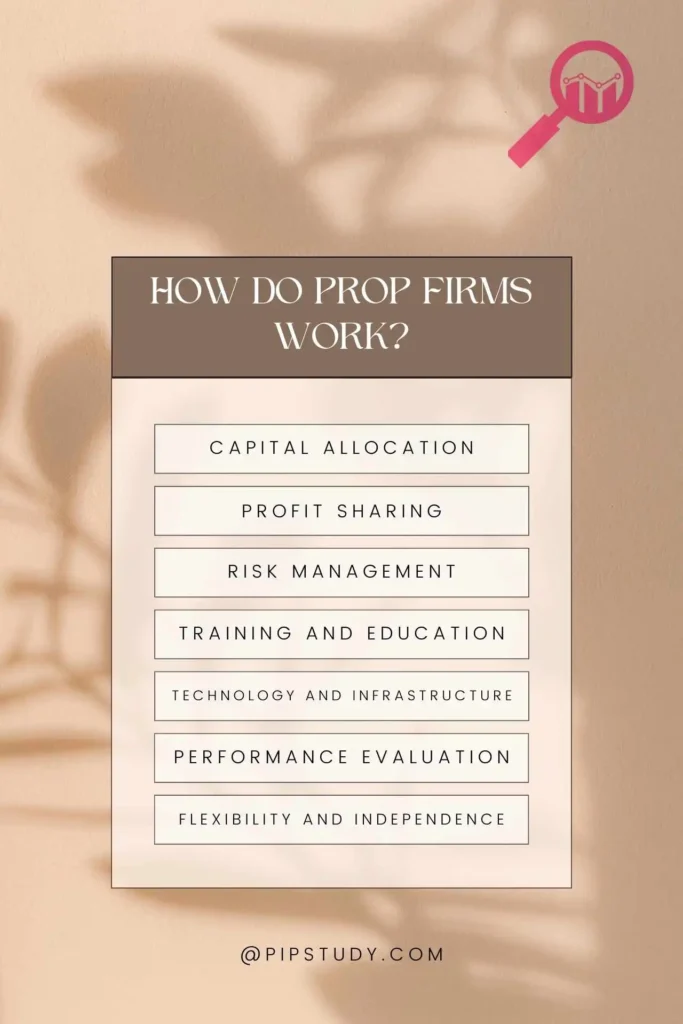

How do Prop Firms work?

Prop firms operate by facilitating traders with the necessary capital and resources to engage in financial market activities. Here’s a point of how Prop Firms operate:

Capital Allocation: Proprietary trading firms allocate capital to individual traders based on their trading skills and performance.

Traders gain access to the firm’s funds, allowing them to execute trades across various markets, including stocks, currencies, and commodities.

Profit Sharing: Traders in proprietary firms usually distribute a portion of their generated profits with the firm.

Profit-sharing arrangements differ among firms, but they help align the interests of traders and the firm.

Risk Management: Prop firms implement strict risk management policies to safeguard their capital and minimize potential losses.

Traders must follow these rules to ensure the long-term success of both the company and their own trading careers.

Training and Education: Many proprietary trading firms offer training programs and educational resources to assist traders in improving their skills and staying up-to-date on market trends.

This support system allows for ongoing improvement in trading strategies, ensuring traders stay competitive.

Technology and Infrastructure: Prop firms equip traders with advanced trading platforms, market data, and infrastructure to enhance their trading experiences.

These technological tools enable efficient trade execution, real-time position monitoring, and market analysis.

Performance Evaluation: Prop firms closely monitor traders’ activities to evaluate their performance.

This evaluation process helps identify strengths and weaknesses, provides valuable feedback to traders, and assists in optimizing trading strategies.

Flexibility and Independence: Trading with a prop firm provides traders with the freedom to set their own trading hours and implement their preferred strategies.

Traders have the freedom to adapt to their preferred trading styles and also benefit from the resources provided by the firm.

Are Prop Firms legit and trustable?

The simple answer to the question “Are prop firms legit?” is, yes. Some prop companies are completely legitimate!

The business model of prop firms is not inherently fraudulent.

Many people are worried since online prop firms are not regulated. As a result, scam firms engage in fraudulent activities.

However, it’s important to note that not all prop firms are illegitimate. There are some precautions you can take to protect yourself from fraudulent prop firms.

Why are many Prop Firms not regulated?

Many proprietary trading firms operate without regulatory oversight, which has raised concerns about their facilitation of trading activities.

These firms are able to avoid many rules due to several key distinctions. Firstly, they handle their own capital instead of client funds.

In addition, numerous prop firms do not offer traders real funds to manage; instead, the accounts serve as virtual learning simulations.

From a technical point of view, this model does not involve any actual financial transactions.

Companies can adopt successful strategies from top performers and maintain oversight of their trading activities. They highlight their main focus on education rather than offering regulated financial services.

Government agencies are beginning to raise concerns about this presentation, and regulations for prop firms may eventually develop similar to those for Forex brokers (such as IC Market).

Currently, prop firms operate within legal boundaries due to their separate structures.

The lack of regulations can be both risky and beneficial. It claims to provide a simpler and more affordable way for skilled traders to access.

However, a potential drawback is the absence of safety measures, which means that individuals are primarily responsible for determining legitimacy.

It is important to exercise caution when differentiating between trustworthy opportunities and questionable ones in this rapidly changing field without proper safeguards.

Increased transparency regarding prop firm models could potentially address the legitimate skepticism of observers.

How to spot a scam Prop Firm?

Here are some tips to spot a potential scam prop trading firm:

- No web presence? Be careful. Legit companies have good websites and online feedback.

- Can’t find customer support? Watch out. Solid firms want their traders to feel helped.

- Promises of big profits or no risk? Stay skeptical. Trading always comes with uncertainty.

- Seen a lot of very negative or very positive reviews that are similar? It could be fake feedback.

- There are lots of unanswered questions about costs, how to fund your account or how to withdraw money? That’s a warning sign. Clear companies have no problem explaining.

- Can’t find details about the firm’s leaders and their history? That’s fishy.

7 safe ways to use Prop Firm:

Here are 7 safe ways that you can use to Prop Firm:

- Research: Before joining any prop trading firm, conduct thorough research. Read reviews on platforms like Trustpilot to understand the experiences of other traders.

- Reputation: Trade with established firms known for their track record. OptimalFx and FTMO are examples of such firms in the industry.

- Diversify Your Risk: Aim to have funded accounts with at least two different firms. This ensures you do not rely on a single source of income.

- Regular Payout: Arrange to have your profits paid out monthly and deposit them into your personal account. This helps you build your trading balance gradually.

- Trading Tools: Leverage trading tools like MT4 copier. This tool allows you to replicate trades between accounts, making it easier to manage multiple accounts.

- Trade Consistently: The key to success is to consistently trade as many funded accounts as you can handle and diversify your sources of funding.

- Trust the Process: Believe in the process of steady trading and compounding profits each month. Success in trading comes from being consistent in the long run.

Final Words:

Scam firms do their fraudulent activities. As a result, traders are concerned about, “Are prop firms legit?” Proprietary firms are legal.

But it’s true most online prop firms are not regulated and do scam traders. You need to be careful about scamming prop firms.

There are some precautions you can take to protect yourself from fraudulent prop firms.